descendants) of the Settlor(s) (including individuals who are adopted, legitimated or illegitimate descendants) Default Beneficiaries Insert GIVEN NAMES of the person(s) you wish to benefit and state the share you wish them to have. the shares of stock or bonds of a corporation which have been sold and distributed. Any children, grandchildren or remoter issue (i.e. to send out, promulgate, publish or make the original distribution, such as a corporation selling and distributing shares of stock to its initial investors. The settlors, who were husband and wife, each executed a trust deed in mirror terms in 1992, creating discretionary trusts. any matter of dispute in a legal controversy or lawsuit, very commonly used in such phrases as "the legal issues are," "the factual issues are," "this is an issue which the judge must decide," or "please, counsel, let us know what issues you have agreed upon." 3) v. While a child or children are alive, issue refers only to them, but if they are deceased then it will apply to the next living generation unless there is language in the document which shows it specifically does not apply to them. Occasionally, there is a problem in determining whether a writer of a will or deed meant issue to include descendants beyond his or her immediate children. Any person entitled under the Will or intestacy of the Settlor 5. The children and remoter issue of the parents, brothers and sisters of the Settlor 4.

The parents, brothers and sisters of the Settlor 3. The children and remoter issue of the Settlor 2. The potential beneficiaries can also include bloodline planning for further generations that are yet to be born, these are referred to as issue and remoter issue. The people to whom the Trustees may distribute the Trust Fund: 1. These are: The types of documents sought: basic documents such as the trust deed should be considered differently to more remote documents such as a memorandum of wishes. As a trust has a perpetuity period/lifespan of 125 years. The Supreme Court identified a range of factors that a trustee should consider when deciding whether to disclose trust information to a beneficiary. It does not mean all heirs, but only the direct bloodline. This is a clause that lists the individuals that the settlor wishes to benefit from the trust assets. (b) the children and remoter issue of the Settlor (or either of them).

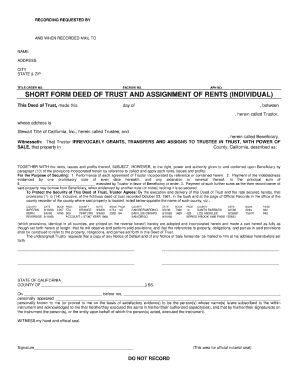

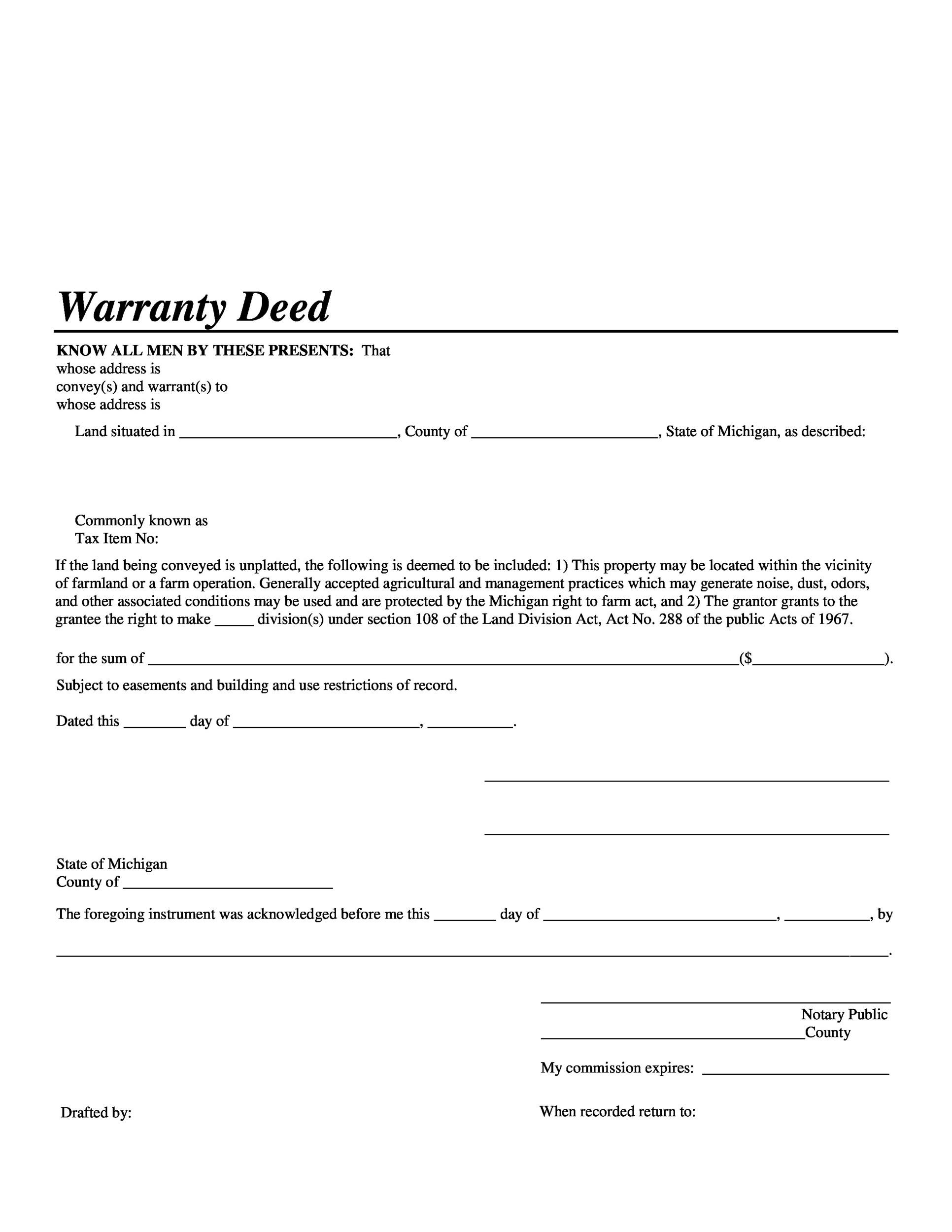

The beneficiaries are defined in the trust deed as being the settlor, the settlor's. The trust is a discretionary trust expressed to be governed by the law of Jersey. a person's children or other lineal descendants such as grandchildren and great-grandchildren. Guidance to completion of the Trust Deed. The trust was established by trust deed dated 19th July, 1988, made between VB as settlor (the settlor) and Radcliffes Trustee Company SA (Radcliffe) as trustee.

0 kommentar(er)

0 kommentar(er)